Shetland;135492 wrote:Aminatidi;135486 wrote:King Lodos;135418 wrote:I'm slightly pessimistic on All Weather going forwards .. But I think you can put CGT's success down to them doing things that are fairly likely to work over long time-scales .. So all three maintain this market neutral asset allocation (which we know works with HB –> it's unpredictable events that tend to be the problem); CGT particularly factors in value between asset classes, and consistently buying ITs below their NAV (two forms of value investing in which I think you do still get clear price disparities); it makes full use of the free lunch of diversification; and they all have a long-term macro outlook (short-termism being a major problem for retail funds .. I think they perhaps have the luxury of older, more experienced investors not expecting everything to perform like SMT)

This is something I spend a fair bit of time thinking about.

I've been doing this for almost 3 years.

It would be

so easy to look at the recent history and assume that things simply keep going up.

I often find myself reading the annual reports of the the likes of Personal Asset or Capital Gearing simply because they seem to be run by people who have been there and got the tee-shirt so to speak.

Keeps me grounded and stops me trying to think I'm too smart.

But CGT and PNL still rise and fall with the markets, its just that the percentages are smaller. They don't go up so much so they don't fall as much. Over the medium and long term, 18 months or more, a low cost index tracker will perform better.

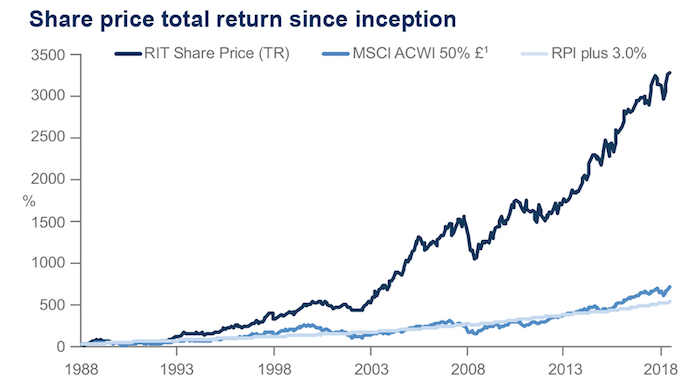

What's going on over the longer-term with CGT, PNL, Harry Browne, etc. can be explained a bit better by this:

If your £100 portfolio loses 50%, it's worth £50 .. So to get back to even, you now need a 100% return.

If you hit a really big crash, like the Tech crash or Japan, and go down 80%, your portfolio's now worth £20, and you

really do need a 400% return to get even. (doesn't apply to very short-term volatility, which tends to be down to liquidity.)

So – while only talking about the past – if you look at the long-term chart of RIT Capital Partners, it

appears to be very high growth ..

but it's not .. This is a portfolio that's tended to only capture about 75% of market upside, but avoid 50% of market downside .. So because it's not hitting bear markets full force, it avoids this anti-compounding effect, and therefore manages to compound at a higher overall rate